Yield to Maturity (YTM)When investors evaluate and trade bonds they commonly consider yield to maturity (YTM), which is the rate investors earn if they buy the bond at a specific price (Bo), and hold it until maturity. The yield to maturity on a bond with a current price equal to its par, or face, value will always equal the coupon interest rate. When the bond value differs from par, the yield to maturity will differ from the coupon interest rate. In other words, the current value (Bo), the annual interest, (I), the par value, (M), and the years to maturity (n), are known, and the yield to maturity must be found (Albany.edu, 2007).

The YTM can be found in one of three ways: by trial-and-error, approximation formula, or hand-held business/financial calculator. The trial-and-error approach involves finding the value of the bond at various rates until the rate causing the calculated bond value to equal its current value is found.

The hand-held business/financial calculator provides accurate YTM values with minimum effort (Albany.edu, 2007).

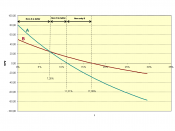

The following example demonstrated the application of each of these methods for finding YTM (Dunbar, 2000):Example: A Company bond, which currently sells for $1,080, has a 10% coupon interest rate and $1,000 par value, pays interest annually, and has 10 years to maturity. Since Bo (bond value) = $1,080, I (annual interest on a bond) = $100 (.10 x $1,000), M (par, or face, value of a bond) = $1,000, and n (relevant period, or number of years to maturity) = 10 years.

$1,080 = $100 x (PVIFA k ÃÂ, 10 years) + $1,000 x (PVIF k à10 years)The objective is to solve the equation for kd â the YTM.

Trial-and-Error - Since they know that a discount rate, k d, of 10% would...